epf i akaun investment

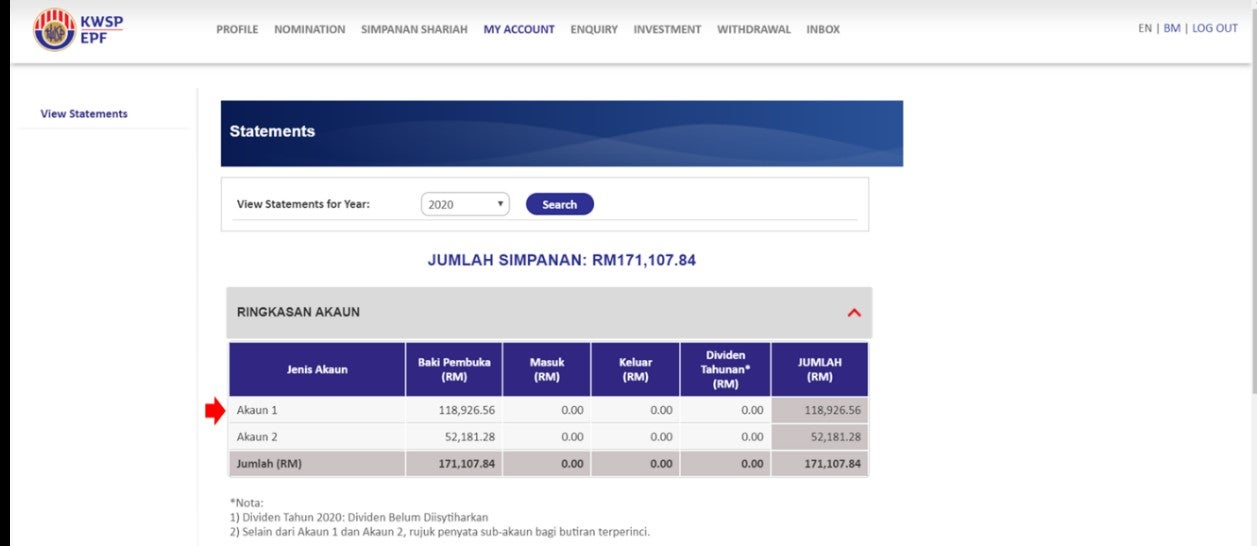

Requirements Malaysians i-Akaun Member user Have a balance in EPF account Types of Protection Offered Life protection Critical illness protection Key Features of i-Lindung Seamless journey The simplest way to purchase protection products with no medical check-up required Quick quotation Get a quotation online for all products offered. If your EPF Account 1 savings balance is RM50000 the Eligible Investment Amount is.

Open your Manulife investment account Step 4 Client suitability Assessment Fund purchase procedure confirmation Login to Employee Provident Fund EPF i-Akaun Step 1 Members need to proceed to i- Invest Step 2 Members sees a list of funds on i-Invest platform Step 3.

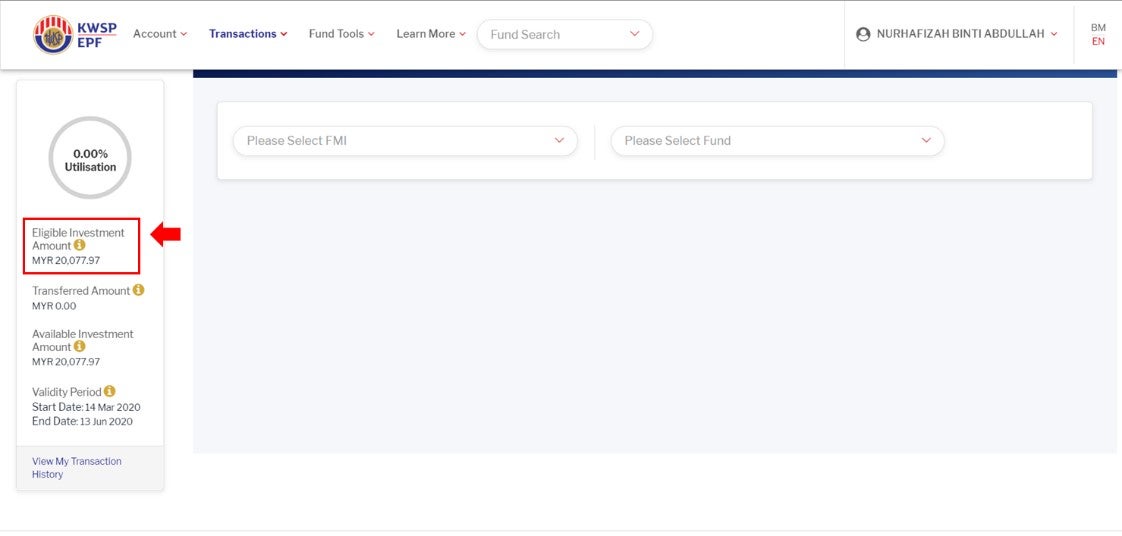

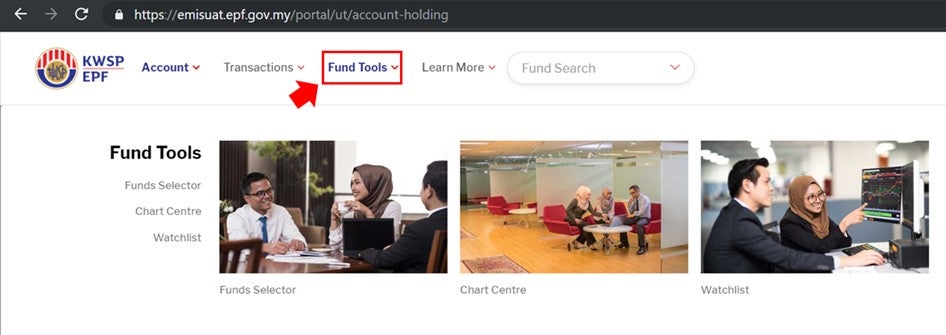

. First in the world to directly link members retirement funds to online investment services. Log into i-Akaun Select Investment tab to proceed Select Transaction and subsequently Buy tab Select Kenanga Investors Berhad on Please Select FMI Select your fund from Please Select Fund Enter amount and select Proceed to checkout. Meanwhile members aged 55 and above can utilise i-Invest using Akaun 55 or Akaun Emas.

1 Sales charge capped at 05 maximum. Click on the INVESTMENT tab. EPF i-Invest is the self-service online platform which allows EPF i-Akaun users to divert part of your EPF funds in unit trusts.

What are the benefits of investing via EPF i-Invest. You are a registered user of EPF i-Akaun. Log into your i-Akaun wwwkwspgovmy.

Press 0 to talk to the nice operator then answer some personal questions for identification purposes. Its selling points are easy to see. Ensure that you have an Available.

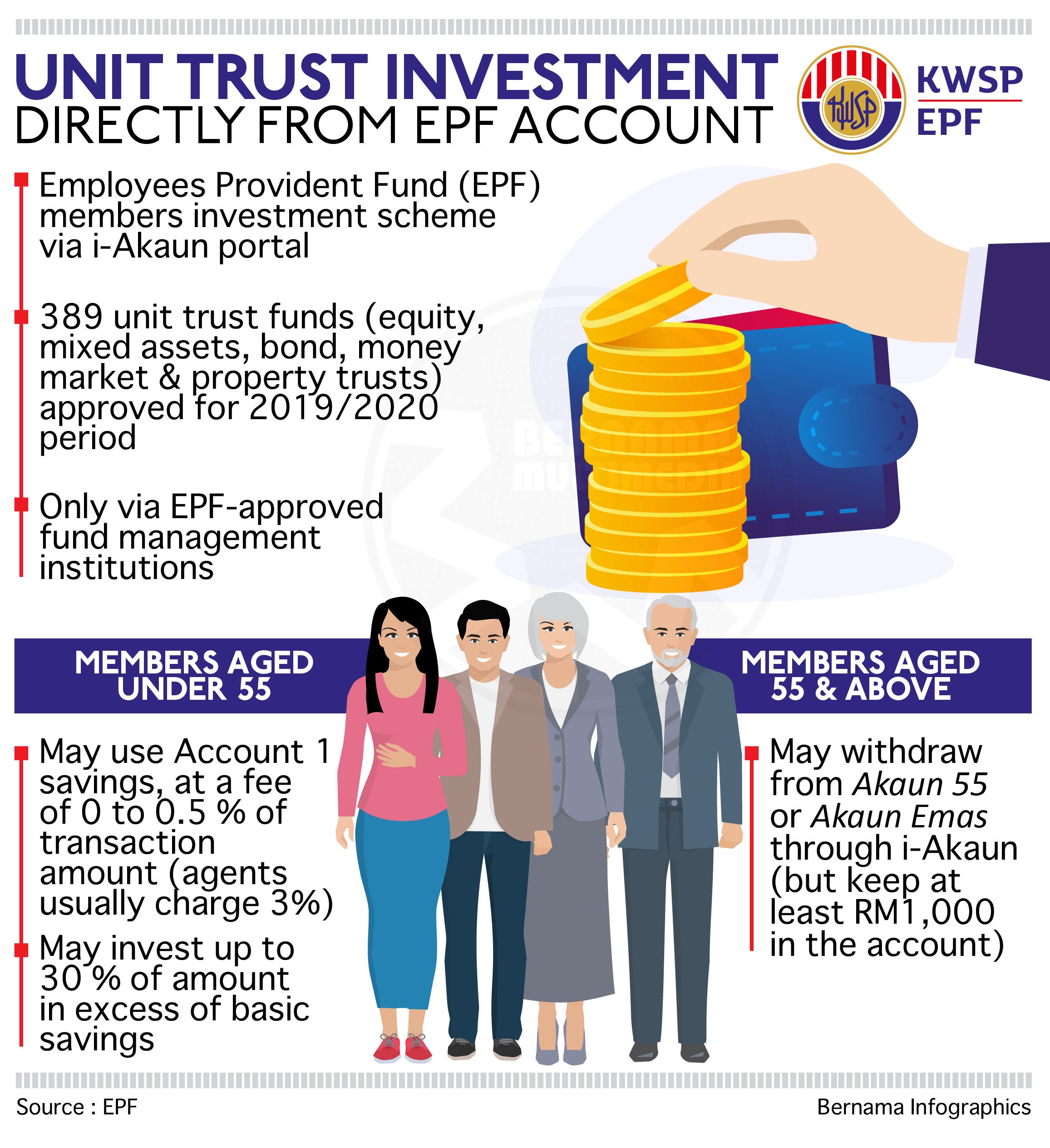

Amount that can be invested is 30 of the savings in excess of Basic Savings required in Account 1. TAIM e-Invest is a digitally powered platform that provides flexibility convenience and functionally for EPF members to invest transact and monitor their unit trust investments. Invest for FREE It used to be 3 now is 0.

Sales charges are reduced as the EPF has enforced a maximum cap of 05 compared to the current 3 for offline and traditional transactions through agents. EPF i-Invest Programme Message to Investors Invest Your EPF digitally with Principal Asset Management via FinAIMS Lee Chin at 0 sales charge and enjoy portfolio management by Lee Chin. Mouse over the TRANSACTIONS tab and click on the BUY tab.

Go to EPF counter or EPF Kiosk or. Minimum investment is RM1000. Members above the age of 55 years old are still eligible to invest provided you have savings in your EPF Akaun 55 Akaun Emas.

Useful information on approved unit trust funds and fund management institutions FMIs offering them are now accessible in the i-Akaun mobile application with more features to come in the months ahead. How to Create EPF i-Akaun For first-time login get the activation code first. I believe low sales charge is THE reason why so many EPF members bought unit trust through EPF i-Akaun.

A key element of the online investment facility according to Tunku Alizakri was that sales charges were now practically free as the EPF has enforced a maximum cap of 05 per cent compared to the current 3 per cent for offline and traditional transactions through agents. I-Invest has a number of new web features including. Theyll send the code via SMS.

Transactional functions Suitability assessment and. Welcome to i-Akaun Member Frequently Asked Question FAQ i-Akaun Member Login. You have a particular fund in mind.

RM50000 - RM35000 x 30 RM4500. The facility is meant to offer members greater autonomy over their retirement savings as well as to simplify the overall investment process. The Benefits of Investing through EPF-MIS How to Invest The amount that can be invested is 30 of the savings in excess of the Basic Savings required in Account 1.

They are also able to monitor their investments at their own convenience compare the various funds that are on offer as well as assess required statutory information. EPFs i-Invest in 4 simple steps. The i-Invest facility was first launched back in August 2019 and sought to allow members to invest their EPF savings into unit trust funds from approved FMIs directly from their EPF i-Akaun portal.

Qualified EPF members can choose to invest into EPF-qualified unit trust funds with fund management institutions IPD appointed under the EPF-MIS. The i-Invest portal was first launched back in 2019so that EPF members can conveniently invest their Akaun 1 savings directly into approved unit trust funds provided they meet specified criteria. I-Invest - Employees Provident Fund.

EPF i-Invest is Employees Provident Fund EPFs self-service online transaction platform which allows eligible EPF members with EPF i-Akaun to invest in EPF-qualified unit trust funds with their savings from EPF Account 1. Call KWSP at 03-89226000. 2 Lots of unit trust options.

The FIAC has asked the EPFO to put in place a team of experienced investment and project managers which have a credible track record to monitor investments in InvITs and REITs. First Time Login i-Akaun Activation Forgot User IDPassword. You can do this by.

With the online facility members can invest anytime and anywhere at their convenience and EPF members can now invest more efficiently through EPF i-Invest i-Akaun. This page will also provide details of the Eligible Investment Amount and Available Investment Amount. If you have already invested RM2000 through MIS within the current validity period the Available Investment Amount is RM4500 - RM2000 RM2500 which is more than the minimum MIS investment amount of RM1000.

Minimum investment amount is RM1000. What are the steps to invest in Kenanga Investors funds using the EPF i-Invest. 1 Log in to your EPF i-Akaun 2 Select Investment on the menu bar 3 On the buy screen select Principal then choose your fund s You can start investing with RM1000 4 Select Principal as your preferred Fund Management Institution FMI and complete your transaction Start investing EPFs i-Invest Funds.

Epf Members Can Track Investment Performance Returns Online

Pelaburan Unit Amanah Islam Kelayakan Skim Pelaburan Ahli Kwsp Untuk Pelaburan Dalam Unit Amanah Unit Trust Islam Sejarah Malaysia

General Information Epf I Invest Via I Akaun Principal Asset Management

Predicting The Next Market Crash Using Shiller P E Ratio

A Complete Guide To Epf Members Investment Scheme Best I Invest Fund Youtube

Epf I Invest Features You May Not Know About

Epf I Invest Features You May Not Know About

Bernama On Twitter Epf I Invest Online Platform Enables Unit Trust Investment Directly From Epf Account Https T Co Ld4hsudysn Https T Co 7aqbflb4dk Twitter

How Epf Digitalising Its Customer Journey

General Information Epf I Invest Via I Akaun Principal Asset Management

General Information Epf I Invest Via I Akaun Principal Asset Management

Epf How To Apply For Epf I Invest Mypf My

Investment On Kwsp I Invest The Research Files

Comments

Post a Comment